It demonstrates liquidity for paying its suppliers and can be used in any analysis of a company’s financial statements. The ratio measures how often a company pays its average accounts payable balance during an accounting period. To calculate accounts payable turnover, take net credit purchases and divide it by the average accounts payable balance. To demonstrate the turnover ratio formula, imagine a company’s total net credit purchases amounted to $400,000 for a certain period. If their average accounts payable during that same period was $175,000, their AP turnover ratio is 2.29.

Typically, your supplier will issue credit memos if delivered goods were damaged on arrival or if there was a billing error. When viewing this report, you’ll know right away which invoices must be paid first, and you can plan your cash outlays accordingly. Track benchmark AP turnover ratio in your industry for periodic comparisons.

It means the company has plenty of cash available to pay off its short-term debts in a timely manner. This can indicate that the company is managing its debts and cash flow effectively. The AP turnover ratio is one of the best financial ratios for assessing a company’s ability to pay its trade credit accounts at the optimal point in time and manage cash flow. A high accounts payable turnover ratio indicates better financial performance than a low ratio. A higher ratio is a strong signal of a company’s positive creditworthiness, as seen by prospective vendors. The receivable turnover ratio measures how often a business collects its accounts receivable balance during a specific period.

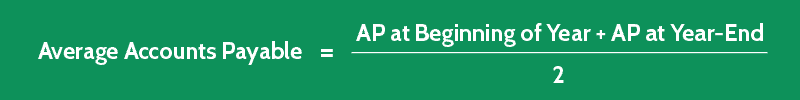

That, in turn, may motivate them to look more closely at whether Company B has been managing its cash flow as effectively as possible. Eliminate annoying banking fees, earn yield on your cash, and operate more efficiently with Rho. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you. Add the beginning and ending balance of A/P then divide it by 2 to get the average. Now let’s have a look at an AP turnover example so you can see exactly how to find this ratio in real life.

When assessing your turnover ratio, keep in mind that a “normal” turnover ratio varies by industry. Company H is showing promise as a potential investment for your portfolio, and you’d like to evaluate how quickly it turned over its supplier payments last year. With this data at your fingertips, cross-departmental collaboration becomes more productive, allowing you to identify opportunities to improve efficiency and AP turnover to help the business grow. Instead, investors who note the AP turnover ratio may wish to do additional research to determine the reason for it.

This information can be particularly useful when you’re analyzing ratio results over a period of time, because it lets you gauge any change in an organization’s payment habits. Another industry that can benefit from a high Accounts Payable Turnover Ratio is the healthcare industry. Healthcare providers need to purchase a large volume of medical supplies and equipment, and they need to pay their suppliers on time to ensure a steady supply of essential items. A high Accounts Payable Turnover Ratio can help healthcare providers negotiate better prices and payment terms with their suppliers, which can ultimately lead to cost savings for patients. In short, in the past year, it took your company an average of 250 days to pay its suppliers. When you purchase something from a vendor with the agreement to pay for the purchase later, you make an entry into your accounting system debiting an expense and crediting accounts payable.

The AR turnover ratio measures how quickly cash is collected from customers. The AP turnover ratio, on the other hand, calculates how many times a company pays its average accounts payable balance in a period. The AP turnover ratio is unique in that businesses want to show they can pay their bills on time, but they also want to show they can use their investments wisely. Investors and lenders keep a close eye on liquidity, debt, and net burn because they want to track the company’s financial efficiency.

Bargaining power also has a significant role to play in accounts payable turnover ratios. For example, larger companies can negotiate more favourable payment plans with longer terms or higher lines of credit. tax deductions and credits While this will result in a lower accounts payable turnover ratio, it is not necessarily evidence of shaky finances. A higher accounts payable turnover ratio is almost always better than a low ratio.

Vendors will cut off your product shipments when your company takes too long to pay monthly statements or invoices. Accounts payable and accounts receivable turnover ratios are similar calculations. A business that generates more cash inflows can pay for credit purchases faster, leading to a higher AP turnover ratio.

It is used to assess the effectiveness of your AP process and can alert you to changes needed in your financial management. As with all ratios, the accounts payable turnover is specific to different industries. The total purchases number is usually not readily available on any general purpose financial statement. Instead, total purchases will have to be calculated by adding the ending inventory to the cost of goods sold and subtracting the beginning inventory. Most companies will have a record of supplier purchases, so this calculation may not need to be made.