Contents

There are multiple trading methods that make use of these patterns in price to find entries, targets, and stop levels. We will discuss simple and effective Forex patterns that have been proven to work throughout Forex trading history. Harmonic patterns have sets of rules that need to be followed. The size of the extensions and retracements will dictate exactly which harmonic pattern to use on the charts. In the Butterfly Pattern, Point D acts as the point where traders will either buy or sell the trade, depending on the bearish or bullish nature of the pattern.

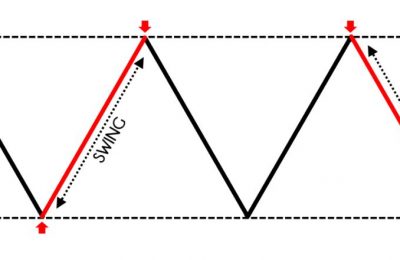

Likewise, the bullish version of the ABCD pattern may incorrectly signal the end of a downtrend. As noted, one advantage of the ABCD chart pattern is that it’s usually relatively easy to spot. Finally, point D is new, lower than point B intraday low, the point at which the ABCD pattern predicts that a trend change from downtrend to uptrend will occur. The final price move in the pattern is a move upward from point C to Point D – a new, higher swing or intraday high above point B.

The ABCD pattern is the most straightforward chart pattern to identify. If the stock holds support at C, I enter the trade as close to the price of C as possible. I hope that the stock will move up or even surpass point D. In short, we are planning for the stock to break above point A, and we consider taking profits at point D. For a bullish ABCD, the investor will look to buy at point D.

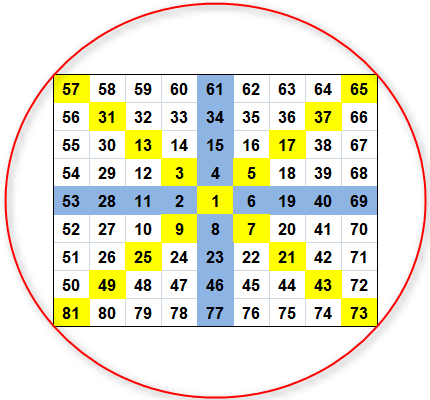

This pattern also has several rules that follow Fibonacci levels, and the most critical one is that the retracement from A to B is 78.6% retracement of X to A. This determines where Point B is calculated and provides insight into where the potential reversal zone will be. If the A occurred at a midtrend bandsupport level , it was further confirmation.

The ABCD pattern is a price action chart pattern that is most often used in intraday trading in the stock market. It can, however, be applied in other financial markets, such as futures, options and forex markets. It also works on a longer time frame if sufficient historical data is available. The ABCD is a market reversal pattern, signaling trend change, either from an uptrend to a downtrend or from a downtrend to an uptrend. Harmonic patterns are used in technical analysis that traders use to find trend reversals.

The ABCD Pattern can be used on your trading platform charts to help filter potential trading signals as part of an overall trading strategy. As with most market reversal trading patterns, there are two versions of the ABCD pattern, bullish and bearish. The bearish version is a price action pattern that signals an impending market reversal from an uptrend to a downtrend. The bullish version provides the opposite trading signal of a likely trend change from a downtrend to an uptrend. By using indicators like Fibonnaci extensions and retracement… The classic version of the abcd trading pattern is a harmonic pattern consisting of two equal legs A-B and C-D.

Click the ‘Open account’button on our website and proceed to the Personal Area. Before you can start trading, pass a profile verification. Confirm your email and phone number, get your ID verified. This procedure guarantees the safety of your funds and identity. Once you are done with all the checks, go to the preferred trading platform, and start trading.

Carlos is leading BBT’s educational programs and its commitment to provide great content for its Success Webinar Series. Aiman’s webinar is scheduled for Wednesday January 15th at 8pm EST in the Lifetime Webinar Room. The ideal scenario is that a reversal of fortunes occurs once again and the price begins to increase, eventually creating a new high. Traders can benefit from high-winning chances as well as solid risk-reward. I’m extremely determined to create a millionaire trader out of one my students and hopefully it will be you. My “Pennystocking Framework” DVD is just one great resource.

These confluence https://forex-world.net/s allowed traders to see where a stock, future, commodity or currency had the greatest probability of pausing or reversing on intraday charts. The end-of-day trader may also use 60- and 90-minute time frames as well as daily and weekly data. By the time either of these types of traders have drawn Fibonacci levels for each pivot point in each time frame, both often have a real mess on their hands. This is a chart used by traders during technical analysis. Traders look to it to identify potential trading opportunities.

You may have heard that maintaining your discipline is a key aspect of https://bigbostrade.com/. While this is true, how can you ensure you enforce that discipline when you are in a trade? One way to help is to have a range of Forex trading strategies that you can stick to.If your Forex trading strategy is well-reas…

Below, we’ll explore what the harmonic pattern ABCD is and how to use it when trading. If you are fortunate enough to find success as a trader, you shouldn’t get too comfortable. A strategy that works for days, weeks, or months is not guaranteed to work forever. It’s also important to observe volume when looking for ABCD patterns.

Pattern Day Trading is limited to stock and equity options trades. Note that long and short positions that have been held overnight—but sold prior to new purchases of the same security the next day—are exempt from the PDT designation. She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans.

If that’s the case, traders can use the sequence to predict when to enter or exit their positions by charting the value of D using the Fibonacci sequence. This strategy will not make you a Genius at day trading but it will increase your odds of becoming profitable and a consistently profitable trader. Volumes of the ABCD patterns have a tendency to be high as the pattern is forming and more compact as the trend culminates. If there’s low volume when you begin to see the pattern forming, that’s a major red flag.

Your short entry will be when prices start to come off that new high with a stop above highs. The bullish pattern surfaces in a downtrend and signals a potential reversal. Note the spike in volume at the morning high of the day. Then a sharp pullback to the breakout level formed the B leg. Keep in mind that if you trade penny stocks, these companies aren’t good companies.

All information on The Forex Geek website is for educational purposes only and is not intended to provide financial advice. Any statements about profits or income, expressed or implied, do not represent a guarantee. Your actual trading may result in losses as no trading system is guaranteed.

Full BioSuzanne is a content marketer, writer, and fact-checker. She holds a Bachelor of Science in Finance degree from Bridgewater State University and helps develop content strategies for financial brands. If you are looking to trade forex online, you will need an account with a forex broker. If you are looking for some inspiration, please feel free to browse my best forex brokers. I have spent many years testing and reviewing forex brokers.

There are other variations for trading the abcd pattern as well. Many intraday scalp traders look to trade the BC pullback as an opportunity to join the AB/CD trend. In other words, if the stock is trending upward on the AB leg, some traders will anticipate the BCD portion of the move by going long and buying the breakout. As with every trading strategy, some traders will swear by harmonic patterns and some won’t believe in them at all. Harmonic patterns are really just a visualization of a Fibonacci retracement move. While it hasn’t exactly been proven that Fibonacci levels are 100% accurate and reliable, there are a large number of traders that use them religiously.

https://forexarticles.net/ price alerts just below the morning highs of each candidate. If you can’t resist, try setting price alerts and physically stepping away until the right time of day. When watching an ABCD pattern play out, it’s tempting to jump into the consolidation level of the C leg before the 2 p.m. A low volume breakout shows there isn’t a lot of interest in the stock.

With that setup, I’m trading the ABCD pattern, but I also want the stock to hold VWAP all day. If a stock’s very choppy or putting in more volume than the A leg during this period, it’s best to skip it. It might be a sign that there are a lot of short sellers fighting the buyers.

Compare that to the standard estimated profit of $500, or a 2% gain on a margin account. The potential for a higher return on investment can make the practice of pattern day trading seem appealing for high net worth individuals. However, like most practices that have the potential for high returns, the potential for significant losses can be even greater. Short-term traders view the pattern on daily or weekly charts to find the potential reversal and then apply it in their trading strategies. Clearly, the AB line must be equal to the CD line, but it is important to take into account the “Fibonacci Levels”. That means traders should find a line going in one of the directions, then pull the Fibonacci grid at the beginning of the correction and wait for the 0.618 level.

In addition,StocksToTrade accepts no liability whatsoever for any direct or consequential loss arising from any useof this information. What this tells us is that supply or demand is coming in strong to create the initial move. Then, when the initial move is complete, you want to make sure that the BC pullback isn’t too strong, otherwise, you might have a “V bottom” reversal pattern.

As a disclosure, I trade with my own money, and this strategy is not for everyone so your results will vary. This strategy was created after watching hours and hours of my live trading video journals and combining with other strategies. The goal of this strategy is to scale into your position using the three entry criteria described above.